Does your daily grind involve dealing with an aircon that doesn’t work (or makes very questionable noises), having a ‘groovy,’ 70’s inspired, orange-coloured vinyl floor (feat. all the Austin Powers vibes), or living in a suburb where your neighbours think mowing the lawn at 6am on a Sunday is a good idea? Maybe you’ve dealt with something similar.

Ah, the life of a renter.

With bills rising by the second, living that cosy, smashed avo lifestyle is anything but straightforward –

especially if you’re keen to ditch the rental and save all the $$ to own your first home.

Saving up money isn’t easy (anyone who says so is totally fibbing), especially when keeping a roof over your head means having to fork out all that hard-earned mooola every week to your landlord.

Well, we’ve got news for you. Ain’t no mountain high enough to keep you from getting your first home, peeps. Where there’s a will, there’s a way – and we’ve got your back on this one.

While putting down an initial deposit remains one of the biggest obstacles standing in the way of homeownership, WA homeowners have the upper hand – thanks to Keystart.

We like to think of Keystart as WA’s Knight in Shining Armour (and one of our fave lenders out there). Srsly, these guys are legends when it comes to homeownership. Keystart offers low deposit home loan options for homebuyers, requiring deposits as low as 2% of a home’s total value.

Considering most lenders require buyers to have a deposit worth at least 10% of a house’s value, we RATE Keystart as the ultimate entry point into the housing market, especially if you don’t have a whole lottaaa savings sitting cosy in your bank account.

To date, Keystart has helped more than 100,000 WA households get into their new home sooner.

Top Perks include:

- No need to fork out $$$ for Lenders Mortgage Insurance (LMI – more on this below) or annoying ongoing fees (we recon banks charging you just to have a bank account is flat out cruel, just sayin’.)

- You totes don’t need to have bucketloads of moola sitting in your bank account to secure your first home, because remember, Keystart allows you to put down a much smaller deposit than normal.

- If you’re super eager to own your first home and don’t want to save for years and years with what might feel like no end in sight – Keystart makes it so much easier to get your foot in the door quicker (literally!)

[Source: Keystart]

Keystart Questions

- I’m not a first home buyer, can I still get Keystart finance?

You betcha! Keystart loans aren’t just for first homebuyers. If you meet the requirements and are eligible, then Keystart is your key to owning a home (see what we did there? Genius, we know.)

- How do I apply for Keystart finance?

We can help you! Feel free to reach out to us at any time, and we’ll show you the ropes!

- What is Lenders Mortgage Insurance?

Commonly abbreviated to LMI, Lenders Mortgage Insurance is normally a once-off payment made by the homebuyer (the borrower of a home loan) when a loan is settled.

Peeps, when you have a Keystart loan, you don’t need to worry about paying Lenders Mortgage Insurance – reducing the amount of money you need to save! Winnnner winner chicken dinner, amirite?!

FYI you usually need to pay LMI if you’re borrowing over 80% of your home’s total value.

- Can I refinance a Keystart loan?

You sure can! In fact, Keystart encourages this.

You stand a pretty good chance of moving towards another lender after kicking things off with Keystart if you’ve built up enough equity in your home.

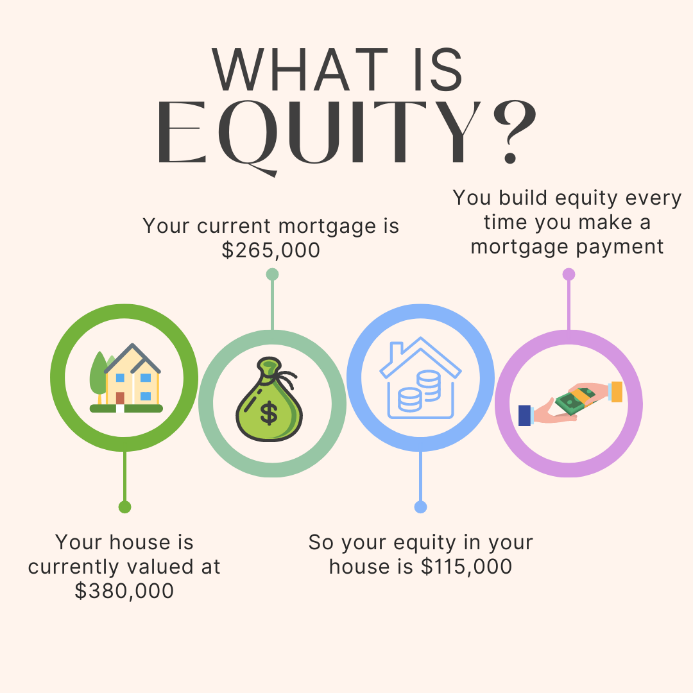

Hmmm, but what’s equity, you ask?

Equity is the difference between the current property market value of your home and what you owe on it (i.e., the balance of your mortgage).

Do You Qualify?

"*" indicates required fields